About the EOG

Originally founded in 2003 by nineteen of the world’s largest outdoor companies, this group recognised the need for a cohesive, cross-border approach to representation of the outdoor sector. We live in a world of increasing internationalism, where legislation, environment, the media and trade are all now multinational issues. The combined strength of our member brands, and a close cooperation with national outdoor associations, provides us with an extremely powerful force to represent the European outdoor industry in a constructive and positive manner.

INFO: European Outdoor Group

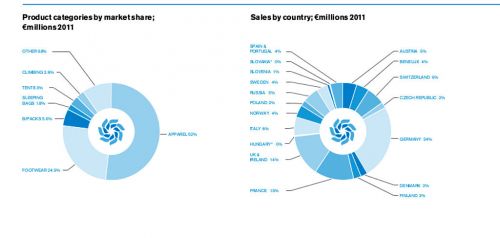

Funded by the European Outdoor Group (EOG), the ‘State of the Trade 2011 - Interim Report’ has highlighted trends developing in the European outdoor market. It builds on the ground-breaking authoritative first report, published last year, covering 2008 - 2010.

New partners in 2011 included industry leaders such as Jack Wolfskin, Petzl, La Sportiva and Original Buff. The success of the project last year and the participation this year of over 100 brands have made the data collated and analysed even more reliable.

Mark Held, EOG Secretary General

Mark Held, EOG Secretary General, said: "Just three short years ago there was no such thing as a reliable numerical overview of the European outdoor industry. And so, with the help of both our membership and the wider industry, we set about developing a basic research programme that would satisfy the brands’ demands for financial data to underpin business decision making. We must never forget that what we collectively achieved was the first ever empirical study that was not based on Retail Panel studies. The fact that data was supplied by the brands in a way that was 100% confidential marks this programme out as different and one that can be trusted by even the largest corporation."

EOG President David Udberg noted: "The combination of uncertainty in the Eurozone, wider economic concerns and unseasonal weather patterns has affected retail sell-through all over Europe and makes more precise comments at this stage of the report basically impossible."

Following the forthcoming peer review, sell-through effects will be clearer by the time the full report is published. What is apparent across the market is the greater competition for market share linked to changing distribution patterns, changes in consumer expectations and evolving buying habits.

Bernd Kullmann, CEO of Deuter

EOG Vice-President Bernd Kullmann, CEO of Deuter Sport, observed: "Participation in outdoor sports is an ongoing trend so the outlook overall is positive but, looking at the actual potential for the market, we have to face a harsh reality. The regions that are strongest commercially are saturated with product and companies are paying a high price to gain market share and deliver growth figures. As an industry, we should be making realistic assessments and try to build a decent but solid growth instead of trying to break records while losing sight of the real strength of market demand."

The 2011 figures confirm this picture; just looking at the pure sell-in figures and not considering inflation (EU average of 3.1% - Source: Eurostat) and currency developments, 2011 was a successful year for the sector and, in the current economic situation, proof that Outdoor is far more than a trend.

Rolf Schmid, CEO of Mammut

The 2012 outlook in the industry is conservative, EOG Board member and Mammut CEO, Rolf Schmid, puts it straight: "Two bad winter seasons and the Euro crisis really hit our sector. The real power of those effects cannot be shown in this wholesale-driven report yet, but full warehouses on both the wholesale and retail sides and an ongoing Euro crisis will have a significant effect on brands in 2012 and put them under pressure until the Euro crisis is solved and stock decreases."

Outdoor Friedrichshafen 2012 na HORYDOLY

Outdoor Friedrichshafen 2011

Outdoor Friedrichshafen 2010

Outdoor Friedrichshafen 2008

Zprávy z veletrhu Outdoor Friedrichshafen 2012 tradičně připravujeme za podpory Media House.

VIDEO

VIDEO FACEBOOK

FACEBOOK TWITTER

TWITTER INSTAGRAM

INSTAGRAM PINTEREST

PINTEREST ENGLISH

ENGLISH